Target Corporation is one of the largest retail chains in the U.S. and has been navigating a period of uncertainty.

From unexpected drops in stock price to missed financial targets, the company has faced several challenges.

In this article, we will explore what is Target stock?, Why is Target stock dropping so much?, Why is target stock struggling?, What are the future expectations for Target stock’s performance?, When should I buy the Target stock for maximum profit?

Target stock:

Why is Target stock dropping so much?

Recent earnings report

Recently, Target reported a significant earnings miss and has led to a 20% drop in stock price.

This decline marks the largest earnings miss in two years and reflects a disappointing financial performance for the retail giant.

Target not only fell short in earnings but also cut its forecast expecting earnings per share (EPS) to range between $8.30 to $8.90 USD for the full year.

It is a notable drop from the previous $9.00-$9.70 forecast. This represents a 20% huge decrease marking the first revenue miss since August 2023.

Consumer behavior trends

Target’s challenges extend to consumer behavior.

Despite aggressive price cuts on staple items like groceries, diapers and other essentials, the sales have not picked up as expected.

The current Target stock’s struggle is compounded by Walmart’s recent success as it outperformed expectations and increased its forecast.

Since Walmart’s outlook has brightened, Target faces difficulties in driving traffic to its stores even with discounted prices.

Market environment

Target’s troubles are not isolated.

Inflation and shifts in consumer spending are impacting the retail sector.

In this environment, the failing in the price is to exceed market expectations and has resulted in severe consequences for Target’s stock.

Walmart’s performance, trading at its 52-week high, contrasts sharply with Target that has reached its 52-week low highlighting a significant divergence in the retail market.

Is Target stock expected to rise?

Expert opinions and market sentiment

Despite the recent downfall, the opinions on Target’s future are remained mixed.

Some analysts from the Wall Street and Seeking Alpha suggest that the current downfall in price may present a strategic buying opportunity, since it is currently at its lowest 52-week price level.

Quant analysts have even rated Target as a “strong buy” citing the stock’s current undervaluation but skepticism remains given the company’s recent track record and the broader economic context.

Target’s forward P/E ratio is estimated at 16.4 which is below the market average. It suggests that the stock might have potential upside if the company can navigate current challenges.

- Also read:

- Jake Paul vs. Mike Tyson, earnings, winners and more

- Nepal PM Oli illegally invested $210 million USD in Cambodia?

- The Game Awards 2024 winners

Company initiatives and strategic moves

Target is making efforts to turn the tide.

It has focused on expanding its digital presence achieving a 10.8% year-over-year increase in digital sales.

Additionally, the company plans to intensify its promotional efforts during the holiday season hoping to boost revenue and attract more customers.

The upcoming holiday season is crucial for Target.

Success during this period could stabilize the stock and potentially lead to a recovery. This is a key time for investors to monitor as holiday performance could be a turning point for the company.

Valuation insights

Some market indicators suggest that Target is undervalued.

Its dividend yield is currently at around 3%. It surpasses the five-year average of 2.49% indicating a potential buying opportunity for investors.

If Target’s financial performance improves, the forward P/E is expected to decrease which could boost investor confidence and drive stock prices higher.

How is Target doing financially?

Key financial metrics

Target’s latest earnings report paints a mixed picture.

While net income has decreased by 12% from the previous year, some areas like digital sales have shown promise but overall revenue and same-store sales did not meet market expectations highlighting ongoing struggles in both physical and online retail sectors.

Long-term financial trends

Over the past decade, Target has seen uneven financial performance.

Its top-line revenue has grown by 40% over ten years but earnings have been inconsistent. The free cash flow and profit margins have fluctuated causing concern about Target’s financial stability.

In spite of these challenges, Target has continued to increase its dividend maintaining its status as a “Dividend King” for 52 consecutive years.

Is target stock overvalued or undervalued?

Current valuation

Target’s stock appears to be trading at a discount compared to its historical averages and sector peers.

Metrics like free cash flow, earnings, and dividend yield suggest that the stock might be undervalued. Analysis using discounted cash flow models and historical P/E ratios supports the idea that Target’s current stock price is below its intrinsic value.

Factors influencing valuation

Institutional and insider trading trends provide further insights into Target’s valuation.

Over the past year, institutional investors have shown increased interest with buying activity outpacing sales. Insider activity has remained stable with few major transactions indicating confidence among company leaders.

Despite recent setbacks, Target’s dividend reliability and market position support its long-term value. Yet, inconsistencies in earnings and financial performance add a level of caution for potential investors.

What’s my advice?

I personally request the investors to stay vigilant and keep a close eye on Target’s upcoming earnings reports and overall market trends to decide whether the current dip is an opportunity or a warning sign. Do all your research. You could also reach out an analyst to get a maximum profit out of your investment in the Target stock. Also, don’t buy until it reaches its lowest value.

FAQs

Is Target stock expected to rise?

The analysts have mixed predictions about Target’s stock. According to a consensus of 31 analysts, Target has a “Moderate Buy” rating with an average 12-month price target of approximately $171.90. It represents potential upside of over 40% from its current price. Hence it is suggested that while some analysts expect growth, others remain cautious due to recent financial challenges.

Why is Target stock dropping?

Target missed recent earnings expectations, cut its forecast and faces challenges related to inflation and consumer spending as well as increased competition from Walmart.

How is Target doing financially?

It has been seen that Target’s financial performance has been mixed with fluctuations in revenue, profit margins and cash flow but it remains a reliable dividend payer with a history of steady increases.

Is Target stock overvalued?

Currently, many analysts consider Target to be undervalued with its stock trading at a discount compared to historical metrics and industry averages.

Where is Target stock company?

Target Corporation is headquartered in Minneapolis, Minnesota, USA. It operates a chain of retail stores across the United States and is known for offering a wide range of products including groceries, clothing, electronics and home goods.

What is Target stock?

Target stock (TGT) refers to shares of Target Corporation. It’s a major American retailer that trades on the New York Stock Exchange (NYSE). People (investors) buy Target stock to gain exposure to the retail sector and benefit from dividends and potential capital appreciation.

How is Target’s stock price prediction for 2025?

Target Stock’s Price Prediction for remains speculative but are cautiously optimistic hinging on Target’s ability to adapt to consumer trends, manage operational costs and stay competitive. If these factors align, analysts suggest potential moderate growth, though exact figures depend on future earnings reports and economic conditions.

When to sell Target’s stock?

Selling Target’s stock may be considered if it reaches or surpasses higher price targets relative to its earning growth potential.

When to buy Target stock?

Please wait for the biggest downfall of the Target’s price. Once, it’s at its lowest price, buy it immediately.

How is Target doing financially?

Target’s financial performance has been mixed with fluctuations in revenue, profit margins and cash flow but it remains a reliable dividend payer with a history of steady increases.

Is Target stock risky?

Target’s stock carries a moderate level of risk due to the current economic uncertainties and competitive pressures. While it offers a consistent dividend, the company’s financial volatility and missed earnings targets raise questions about short-term stability

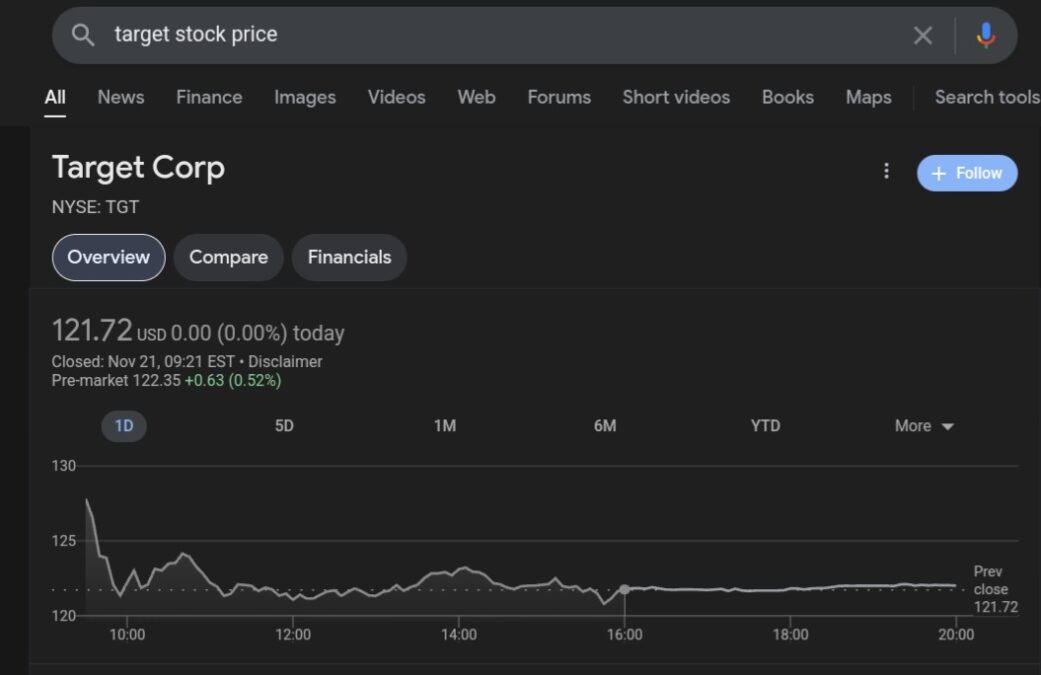

What is Target stock price today?

As of November 21, 2024, the Target’s stock price is $121.72 USD.

Stay tuned to Hi World News for updates on Target stock news.